The "Generic" converter for Invoices

About the "generic" converter for importing transactions to be posted as Invoices (not banking or credit card transactions).

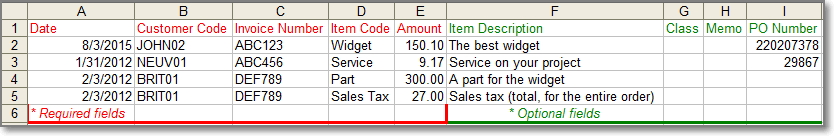

1. DATA LAYOUT

Your data to be converted is expected in the following arrangement of columns. The header row label text is not important.

2. RULES

- The first row in a transaction (invoice or credit memo) must contain all required fields.

- Subsequent lines for the same transaction must have an ITEM CODE and AMOUNT (the Date, Customer, Document number are optional).

- If the Item or Amount are blank/missing, the program will stop processing (no more rows will be converted).

- Any change in the transaction DATE, CUSTOMER or DOCUMENT NUMBER will trigger a new transaction.

- If the total of all rows in a transaction are ZERO OR GREATER, it will be an INVOICE. If LESS THAN ZERO, it will be a CREDIT MEMO.

- Sales tax, if any, must be included in the line item AMOUNT or added as a line in the transaction (on a row by itself).

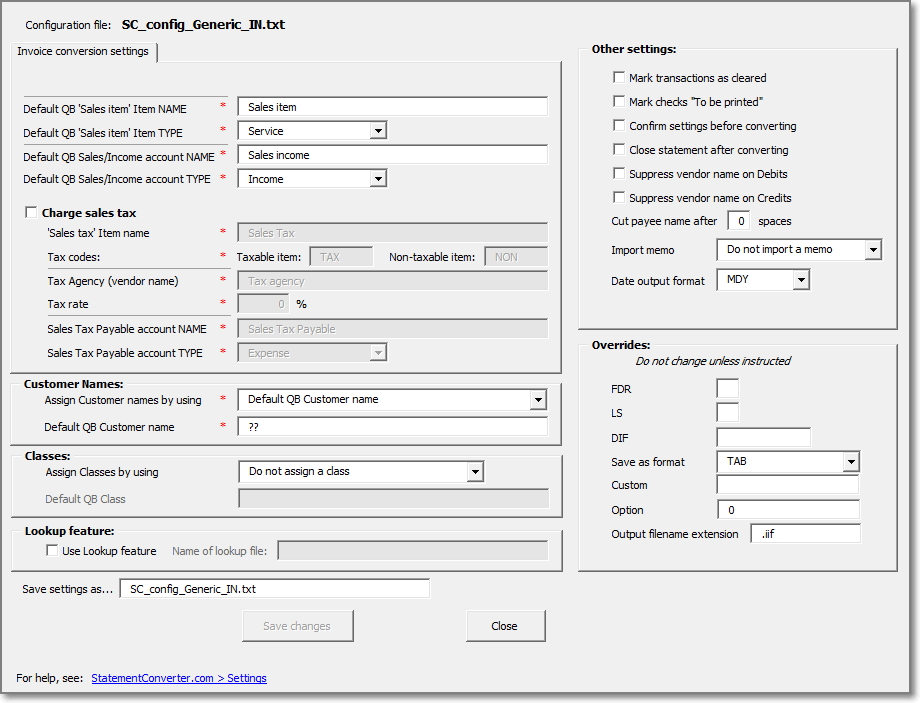

3. CONVERSION SETTINGS

The following settings are available:

DEFAULT QB 'SALES ITEM' NAME: The QB ITEM to be assigned when your data does not specify an item code.

DEFAULT QB 'SALES ITEM' TYPE: The QB TYPE of for the SALES ITEM specified above.

DEFAULT QB 'SALES/INCOME' ACCOUNT NAME: The name in your Chart of Accounts for the sales or income account to which transactions will be posted.

DEFAULT QB 'SALES/INCOME' ACCOUNT TYPE: The QB type of account for the sales or income account specified above.

CHARGE SALES TAX: If you charge sales tax, checkmark this box.

'SALES TAX' ITEM NAME: The QB ITEM to be assigned for Sales Tax.

TAX CODES: From your QB Preferences, which code to use for Taxable items and for Non-taxable items.

TAX AGENCY: From your QB Preferences, the QB Vendor on whose behalf you collect sales tax.

TAX RATE: From your QB Preferences, the percentage tax rate to apply to sales.

SALES TAX PAYABLE ACCOUNT NAME: The name in your Chart of Accounts for the account which holds sales tax you have collected.

SALES TAX PAYABLE ACCOUNT TYPE: The QB type of account for the account specified above.